Middle Class More Likely to Tap Retirement Accounts for Unexpected Expense

ACLI’s Financial Resilience Index has remained above historical norms for eight consecutive quarters. The Index measures middle-class households’ abilities to manage financial challenges and plan for a stable future. Its current reading indicates that above-average cost pressures are still a concern, but middle-class financial resource growth remains strong.

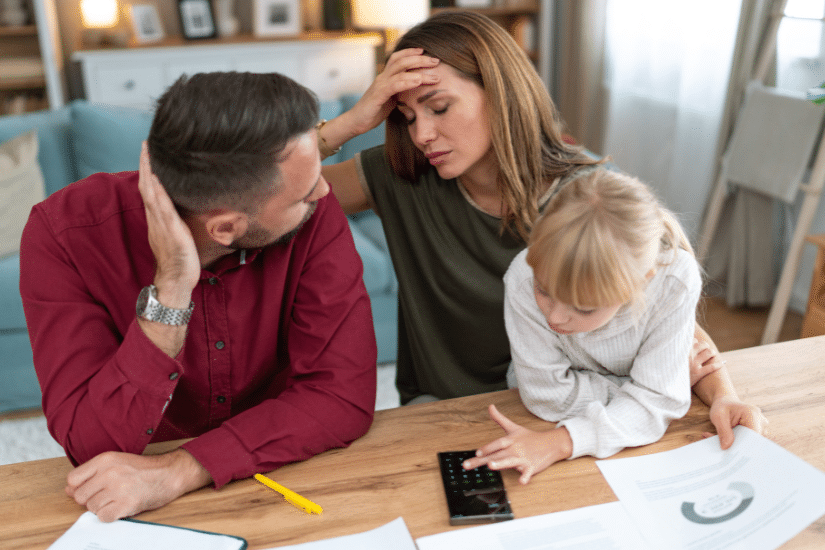

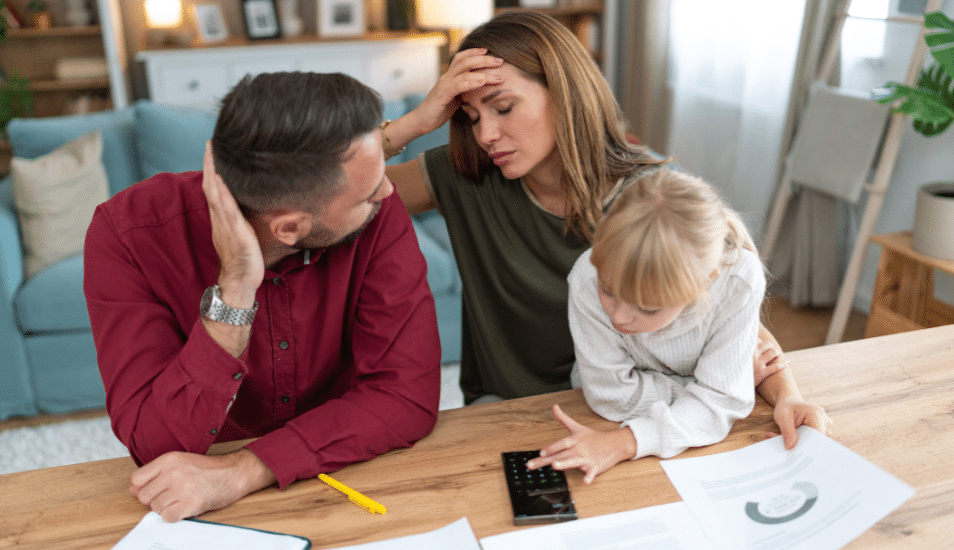

Still, challenges remain for many middle-class families. A YouGov survey accompanying the Index highlighted a particular challenge that affects middle-class Americans.

When faced with an unexpected $5,000 expense, a small but notable share of middle-class households, 5%, said they would withdraw money early or borrow from their retirement account to manage the expense. This makes middle-class households more than twice as likely as lower- and upper-income households (at 2% each) to tap their retirement accounts to pay for a large, unexpected expense.

Middle-class families usually have fewer financial resources than upper-income households outside of their retirement accounts that they can tap for an unexpected expense. And not as many lower-income households have retirement balances that are large enough to tap as a funding option.

Many experts recommend that savers should not touch their retirement savings accounts until it’s time for them to stop working, as early withdrawals or borrowing can limit their asset growth and lessen their progress toward a secure financial future.

Americans are living longer and financial security through retirement is a big challenge for many. With life and disability insurance, annuities, supplemental benefits products and more, life insurers empower individuals and families to protect themselves from risk and take control of their financial future.

(ACLI’s latest Financial Resilience Survey was conducted online within the United States by YouGov on behalf of ACLI from September 10-16, 2025 among 3,330 adults ages 18 and older. The survey sample includes 1,249 respondents from middle-class households as well as 1,382 respondents from lower-income households and 306 respondents from upper-income households. The report and related materials only highlight comparisons between subgroups that are statistically significant. Complete survey methodology, including weighting variables and subgroup sample sizes is available here.)