A Holiday Gift From Financial Professionals to American Families: Financial Security

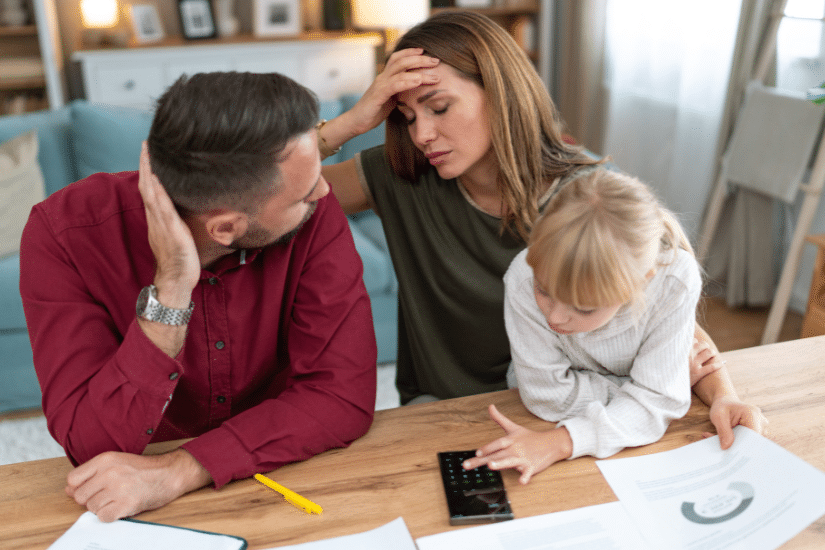

Spending rises for many American families during the holidays. So does financial stress and worry.

But others are less concerned, especially those who have received the gift of financial security from a financial professional.

The Alliance for Lifetime Income by LIMRA’s 2025 Protected Retirement Income and Planning (PRIP) study shows 78% of consumers who work with a financial professional believe they will have enough income to cover their essential expenses in retirement vs. only 58% of all people.

Not only does financial professionals’ expertise provide the assurance to families that things are going to be okay financially, whether in retirement or after the unexpected loss of a loved one, their personal experiences drive them to make sure families have the protection they need.

Kim C. from Connecticut entered the field because she saw first-hand what a tragic death can do to a family.

“I work in life insurance because recently I lost a very dear friend to a drowning over the summer, and I’ve watched the detriment that it caused for the family, not only from a grief perspective, but from a financial perspective as he did not have the appropriate amount of life insurance to support his family to live the same type of lifestyle,” she said. “No one should be having to go through grief and worry about financial stability.”

Similarly, Alexys L. from Minnesota was spurred to enter the industry after seeing the financial impact on her family following her younger sister being diagnosed with a rare neurological disorder.

“I’m extremely happy that I got into the business at 20 years old, and I’m able to have the knowledge that I have today so I can help other families get ahead of those bad problems before they happen,” she said.

Financial professionals from coast-to-coast help Americans plan and prepare to secure financial certainty for their families. Their support is crucial, especially when their clients need it most. They also can help with business continuation plans so that a family business stays within the family, as financial professional Jonathon F. from Wisconsin did not long ago.

“Unfortunately, recently we lost a client in his mid-40s due to a heart attack,” he said. “The life insurance payout that came from several different companies has allowed the widow to carry on the family business that this husband had set up and had been running.”