America is Changing and So Are We: Diversity & Inclusion Initiatives by the Life Insurance Industry

America is becoming more diverse every day. The U.S. Census Bureau projects that our nation will become “majority minority” by 2045.

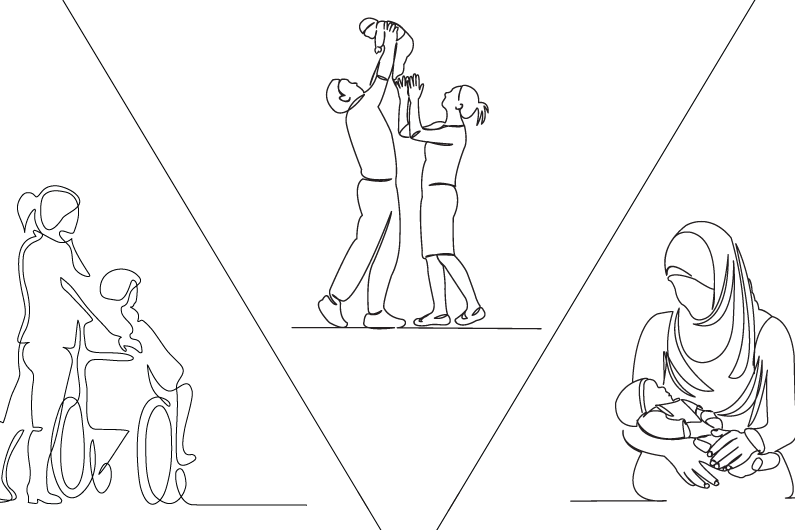

As society and work change, life insurers are committed to empowering all Americans with the information and tools they need to succeed in their financial futures. Building a diverse and inclusive workforce that reflects the wide variety of communities we serve is critical for our success.

According to an industry survey by the American Council of Life Insurers (ACLI), 94% of ACLI member companies have developed policy affirming their commitment to diversity and inclusion. And 92% have a chief diversity officer or an employee whose primary responsibility is diversity and inclusion.

The clearest path to increasing diversity is by hiring talent from under-represented demographic groups. The ACLI survey found that 98% of member companies actively recruit employees from traditionally under-represented communities.

Many companies have adopted recruitment tactics and interviewing strategies to eliminate “unconscious bias,” which can lead to unfair and inaccurate judgments of minority candidates. Some recruitment initiatives include posting open positions on diversity job boards and requiring diverse slates of candidates.

For current employees, life insurers have implemented several measures to foster an inclusive environment. 97% of ACLI member companies have company-supported resource groups for employees from traditionally under-represented communities.

Life insurers are also actively reviewing their initiatives. 95% of ACLI member companies regularly assess their progress in achieving diversity and inclusion.

Life insurers have received recognition for their efforts by media and independent organizations. These initiatives are essential as we strive to provide financial and retirement security products across our increasingly diverse nation.

America looks different today than it did 50 years ago. And it will undoubtedly look even more different 50 years from now.

But one thing stays the same: life insurers’ commitment to help American families build a financial safety net that protects them through all stages of life. Thanks to our continuing efforts to build a diverse and inclusive workforce, we will be better able to serve all American families in the years ahead.