Answers for Long-Term Challenges

Life insurers help people prepare for the future, providing families with financial support through all phases of life.

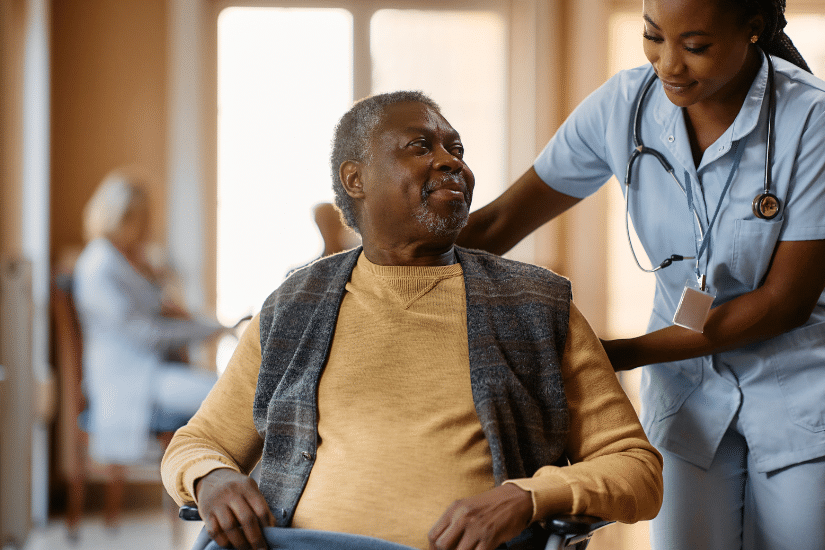

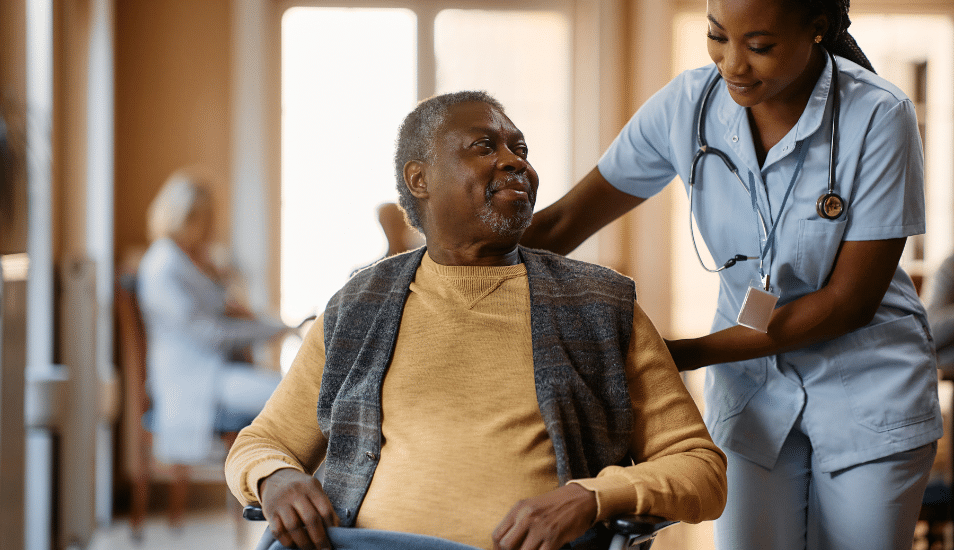

For many, that support includes long-term care insurance.

Life insurers paid nearly $32 billion in long-term care insurance benefits between 2020-23, including $9.6 billion in 2023, demonstrating the significant financial support these policies provide.

Families use their benefits to secure in-home care services, as well as support in nursing homes, community and assisted-living facilities.

About 70% of Americans ages 65 and older will need long-term care at some point in their lives. Many Americans think that Medicare or Medicaid will cover their long-term care expenses. But Medicare only provides coverage for limited long-term care costs, while Medicaid only covers those costs for those who have spent down their assets.

With long-term care insurance, people are assured they’ll have funds to help them remain in their homes or allow them to choose facilities that meet their care needs. It also helps ease the overwhelming burden facing many family caregivers.

Beyond financial benefits, many long-term care insurers offer wellness programs and preventative care initiatives that help policyholders stay healthier longer, reducing the need for intensive care. Programs such as fall prevention, chronic disease management, and care coordination services provide valuable resources to help individuals maintain their independence.

Premiums for long-term care insurance have changed over time as insurers adjust to rising care costs and longer lifespans. While these adjustments can be challenging, they help ensure that policyholders have access to benefits when they need them most.

There is no surefire way to predict the future. But with long-term care insurance, people can be better prepared for it – ensuring they receive the care they need while preserving financial security and independence.