Back-to-School or Back-to-Debt?

It’s back-to-school time for millions of college students.

It’s back-to-debt time for many of them, as well.

Rising costs for tuition, room and board have forced more and more college students to borrow money to pay their bills.

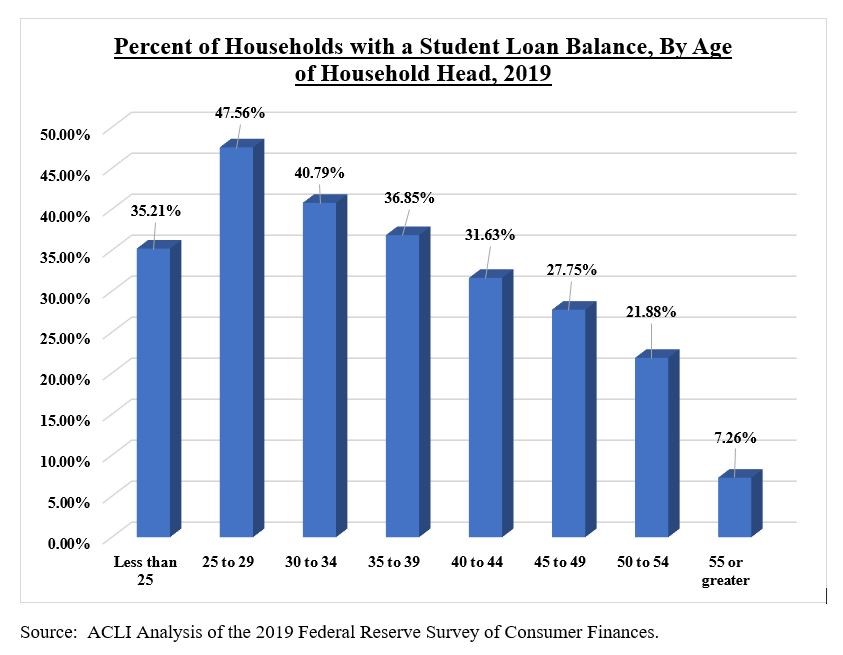

More than 43 million Americans have outstanding student loans, up from 28 million in 2007. The average loan balance is nearly $38,000, double the amount 15 years ago. Nearly 48 percent of American households headed by those between 25-and-29-years-old are burdened by student debt.

The latest round of high inflation will make it even more expensive to attend college. Many recent college graduates already struggle to save money as they begin their careers, which is a critical early step toward long-term financial wellness. Indeed, the median retirement account balance for workers less than 25-years-old is less than $1,800. Throw in a sizable debt burden and it gets even harder.

Parents are affected, too. A new report from EBRI shows more than 40% of workers say saving for or paying off a child’s education reduces how much they can save for retirement.

No one should have to make a choice between higher education expenses and financial security. That’s why life insurers support a provision in retirement legislation under consideration in Congress that would help Americans with student loans.

The provision in a legislation package known as SECURE 2.0 would allow an employer to make a “matching” contribution to an employee’s retirement account based upon the amount of their student loan debt payment.

This could be a genuine game-changer for young workers across the country. With this new law, employers will be assured that these contributions would be permitted under The Employee Retirement Income Security Act of 1974 (ERISA). As employers offer this benefit, more young workers will be able to pay down their college loans while building up their retirement savings accounts.

The cost of college has more than doubled in the past 20 years. Young adults shouldn’t have to sacrifice their long-term financial security to pay for higher education. Congress should help tomorrow’s leaders secure their financial futures by passing a final version of the SECURE 2.0 legislation.