Frightful Time for Harmful Proposal

The U.S. Department of Labor (DOL) picked an appropriate day to dig up a dead-and-buried regulation.

On Halloween, the DOL unveiled a proposal that would limit low- and middle-income Americans’ access to the guaranteed lifetime income provided by annuities.

If this script sounds familiar, you’re right. The DOL made a similar proposal in 2016. The 5th U.S. Circuit Court of Appeals ultimately killed that misguided regulation.

Still, like a typical scary movie, this fiduciary-only proposal refused to die.

The earlier DOL regulation limited access to financial guidance affecting an estimated 10.2 million accounts and $900 billion in savings, according to a study by Quantria Strategies. If it hadn’t been struck down in court, it would have reduced the projected accumulated retirement savings of 2.7 million individuals with incomes below $100,000 by approximately $140 billion over 10 years.

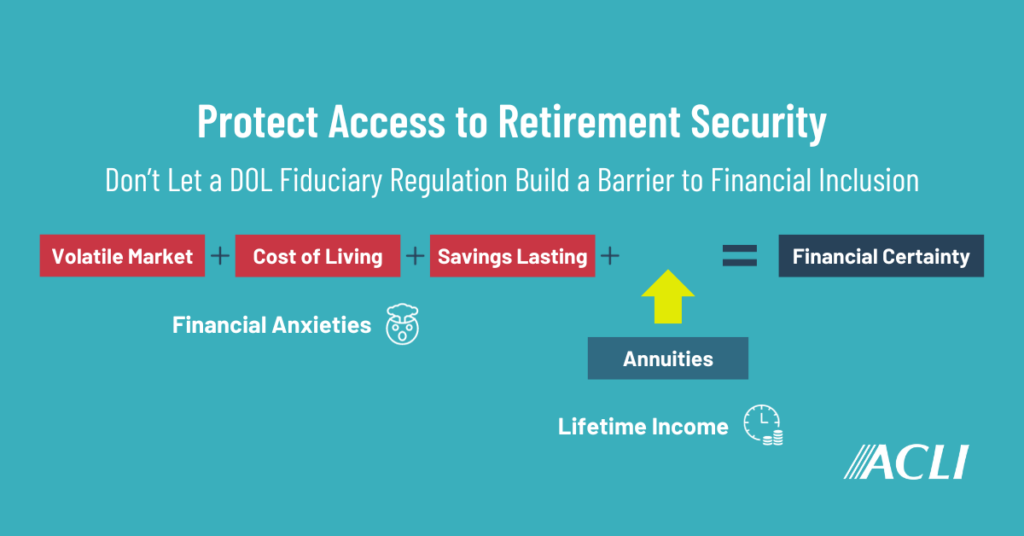

Americans are having a hard enough time preparing for retirement, thanks to the effect of volatile markets on retirement accounts and the high cost of living. According to the Alliance for Lifetime Income, more than half of consumers ages 45 – 75 don’t think they’ll have enough savings to last their lifetime.

The last thing we need now is to resurrect another regulation that would make it harder for Americans to retire.

Guaranteed lifetime income through annuities lets people create their own secure pension. That’s one reason why Americans are purchasing annuities at a record pace, according to LIMRA. With traditional pensions no longer the norm, public policy should be expanding, not limiting access to financial certainty. And the appetite from lawmakers supports that trend – that lifetime income is a critical part of a retirement portfolio.

Congress got it right in 2019 and 2022 when it passed SECURE and SECURE 2.0. These laws close savings gaps and expand access to retirement security, with key provisions to help ease access to annuities.

The DOL’s proposal is counterproductive and inconsistent with the goals of these laws.

Policymakers shouldn’t frighten Americans with harmful proposals that feature misleading and inaccurate claims about “junk fees.” Instead, let’s drive a stake through horrid ideas and work together on ways to ensure that everyone has access to the financial security solutions they want and need.