Life Insurers Provide Answers for Retirement

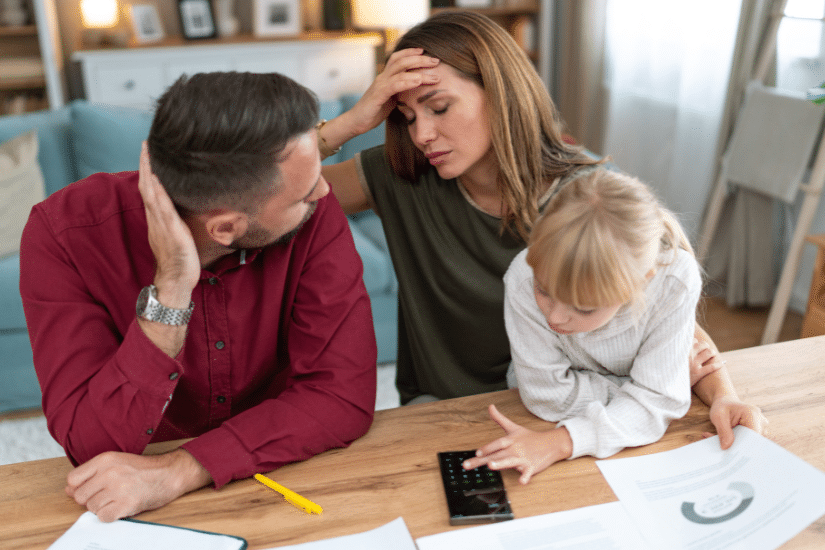

Axios says: “The Retirement Crisis is here.” These challenges are real, but fortunately, so are the solutions.

For more than 180 years, America’s life insurers have helped people plan and prepare to achieve a secure retirement. Life insurers help Americans build a financial safety net that protects them through all stages of life.

Consider these issues facing Americans nearing retirement. Then see how the life insurance industry is uniquely positioned to help them.

1) The Social Security trust fund is scheduled to be depleted in 2033. At that point, recipients could see their benefits cut.

- Only life insurers offer annuities, the only true product in the private marketplace that provides regular income like Social Security or a traditional pension. With an annuity, retirees can rest assured that they will have a guaranteed income stream for as long as they live.

2) Out-of-pocket medical expenses are escalating rapidly.

- Life insurers offer supplemental benefits, including accident, critical illness, and hospital indemnity insurance that can help offset out-of-pocket costs that major medical insurance does not cover.

3) The cost of in-home care is growing more than three times faster than inflation.

- Life insurers offer long-term care insurance, which provides benefit payments to help cover the costs of a nursing home, assisted living or in-home care.

While no one can be sure what the future will hold, life insurers make sure everyone can prepare for it. Our policyholders count on us to plan for tomorrow, so they can live confidently today.