Run Out Of Money? No Way.

More and more Americans are retiring with 401(k) and IRA savings rather than pension benefits. Unlike pensioners, these folks must manage their savings throughout retirement.

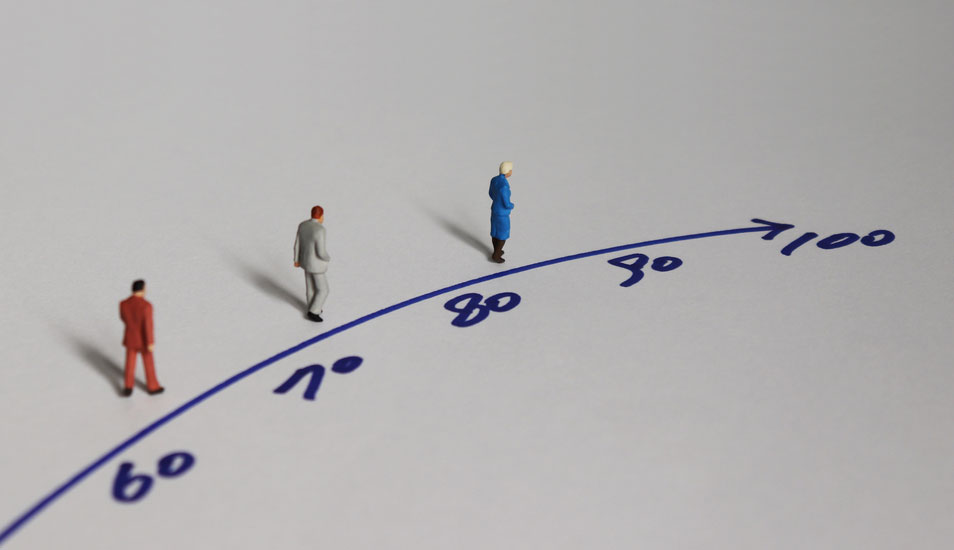

How long will that be? No one knows, but it could be 20 years or more. Financial professionals refer to this challenge as “longevity risk.” Fortunately, there is a way for retirees to address this risk with just a portion of their savings.

There are annuities designed specifically to start guaranteed lifetime income payments later in retirement. Known as “longevity insurance,” these deferred payout annuities can begin payments well after retirement begins, up to age 85.

In 2014, the Treasury Department and IRS issued rules to encourage the use of longevity annuities in employer retirement plans and IRAs. The rules allow retirees to exclude the amount used to purchase a “qualified longevity annuity contract” (QLAC) when calculating the amount required to be distributed annually from their retirement plan. In general, these rules limit QLAC purchases to no more than 25% of a qualified plan or IRA account or, if less, $135,000 (indexed for inflation).

Those who purchase a QLAC are certain they will receive guaranteed monthly payments for the rest of their lives beginning at a set age. For retirees, QLACs take one challenging question off the table: will I outlive my retirement savings? With a QLAC, the answer is no.

There is more good news about QLACs on the horizon, as policymakers in Washington D.C. are proposing more enhancements to the retirement rules. A provision in the recently introduced Securing a Strong Retirement Act of 2020, as well as the Retirement Security and Savings Act, would modernize the rules by eliminating the 25% account cap on QLACs and raising the remaining dollar limit to $200,000 (indexed). Policymakers are also proposing to simplify rules to make a greater variety of annuities available to retirees.

Managing savings in retirement can be challenging. Financial professionals can help retirees manage several financial risks. Annuities are the only solution in the market that is guaranteed to address longevity risk. QLACs remove that worry with guaranteed income for life.