Buyers’ Remorse for Student Loans?

The media routinely report that student loans are a major burden on families and young people. Several presidential candidates have even turned education-related debt into a campaign issue, pushing for across-the-board debt forgiveness.

Is education-related debt really that much of a challenge? How exactly does it impact borrowers? Consider some facts:

- 44.7 million Americans have student loans; 3-in-5 are age 30 or older.

- 63% of Americans under age 30 who earned at least a bachelor’s degree have education-related debt.

- The average education-related debt balance is $36,299.

- 15.4% of all student loan borrowers are either delinquent or in default, though this has steadily declined from a peak of 17.3% in 2012.

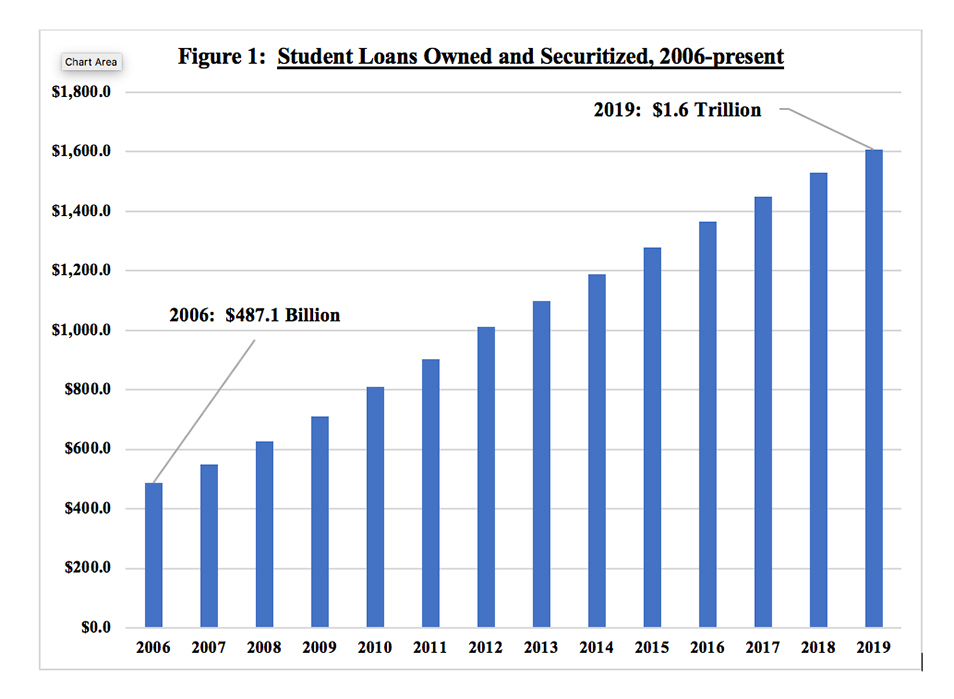

- As of 2019-Q2, Americans owed a total of $1.6 trillion in student loans. This is almost 3.5 times more than in 2006-Q2, the earliest year for which data is available (see figure 1).

Clearly, many people have used debt to finance their college education, which they otherwise may have had to forego. But what are some of the negative consequences of education-related debt? Do borrowers have regrets?

Research shows that most borrowers would have done things differently. According to a survey by Citizens Bank, 74% of “Americans with student loan debt wish they had done more to minimize the burden of their student loans.” A 2019 study in the Journal of Family and Economic Issues, found that “student loan debt is negatively associated with life satisfaction and psychological well-being.”Other studies have come to similar conclusions.

But that’s not all. The burden of education-related debt makes it difficult to plan for the future, including planning for retirement. 84% of those with student loans say they are not saving as much for retirement as they would like, due to their student loans. This should be of concern to policymakers given the demise of defined-benefit plans and low retirement savings rates among younger Americans. Future IMPACT posts will consider ways that employers, policymakers, and life insurers can help.