There’s Never Been a Better Time

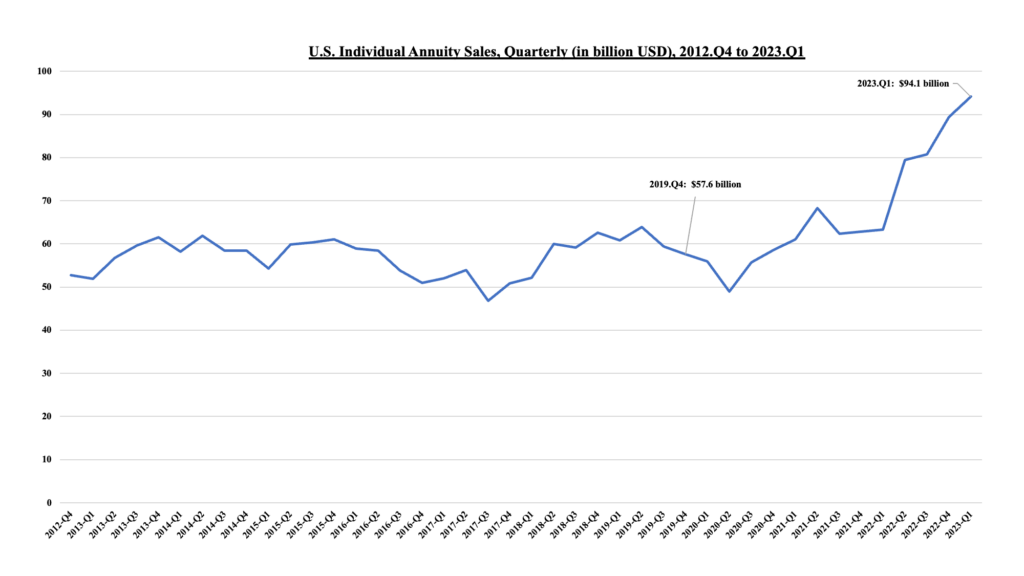

June is Annuity Awareness Month. For most middle-income working families, an annuity can be an important part of preparing for retirement. The median household income of an annuity owner is $70,000. And annuity ownership is growing. According to market research from LIMRA, life insurers’ sales of individual annuities increased 16.2% in 2022, reaching $310 billion. This surge in sales has continued into 2023, with first quarter sales of $94.1 billion, 49% greater than 2022-Q1.

Why are annuity sales increasing? Here are a few reasons:

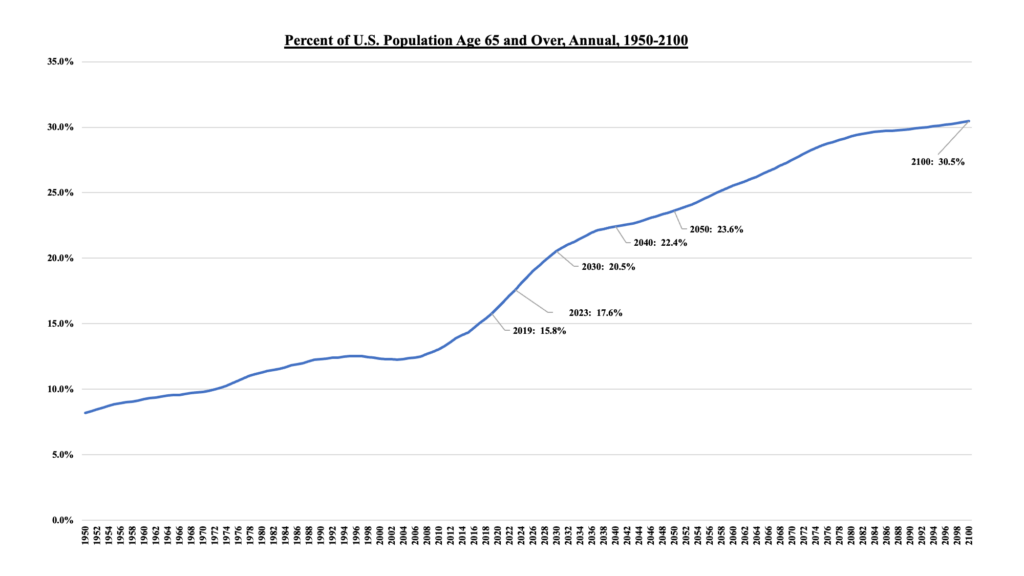

Growing Percentage of Retirees

Retirees and near-retirees are prime purchasers of annuities. The youngest Baby Boomers are now retiring while working-age families are becoming smaller. In 2019, 15.8% of the U.S. population was age 65 or over. Today it’s 17.5%. This trend will continue. By 2050, 24% of the U.S. population will be 65 or over.

Additionally, during COVID many pre-retirees re-evaluated their plans to work while others may have left the workforce due to health concerns. In 2023, there are about 7 million more people of retirement age than prior to COVID. Prior to COVID, 39.3% of people age 55 or over worked, compared to 37.5% today.

Concern about the economy

Given inflation, fear of a recession, higher than usual interest rates, and recent stress in parts of the banking sector, many are looking for security and guarantees. A recent Morning Consult survey of pre-retirees (age 45 to 65) found that today’s economy has increased the appeal of “a guaranteed lifetime income product that pays out like a pension.” Fully 73% of respondents would consider purchasing an annuity.

More Favorable Interest Rates and Regulation

Since March 2022, interest rates have been steadily increasing and are now closer to historical norms. That may not be good news for those purchasing a home or taking out a loan, but it is good news for savers. Higher interest rates help life insurers develop a wider range of more appealing annuity products.

Additionally, 38 states have adopted a best interest standard, with over 75% of the U.S. population now living in a best interest state. A best interest standard strengthens protections for annuity consumers, while not disincentivizing brokers and agents.

(To learn more about annuities, join ACLI’s Twitter chat on Monday, June 26, from 1-2 p.m. ET.)