Could The SECURE Act Enable Fewer People To Work Past Age 65?

Every day, 10,000 Americans turn 65 years old.

For much of the 20th century, the 65th birthday meant retirement.

But not in 2020, according to two recent articles.

A CNBC.com story noted that a majority of workers (54%) said they expect to continue working after age 65, including 14% who never plan to retire.

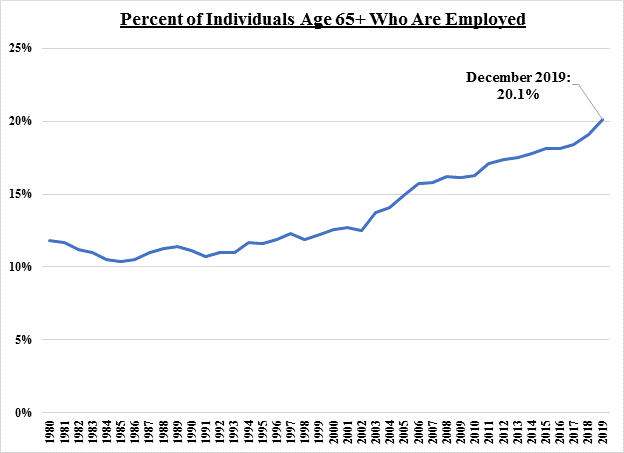

And a Wall Street Journal piece highlighted that the number of people who plan to retire after 65 has tripled since 1995. In fact, over one in five seniors (6.4 million people) are currently employed. That’s the largest share since 1960!

Why do people want to work past 65?

According to research from the Transamerica Center for Retirement Studies, the main reason is the income.

With fewer employers offering standard pensions, workers are largely responsible for managing their own retirement funds to supplement Social Security. And with concerns about Social Security’s long-term funding, it’s easy to see why people feel they need to keep working.

Making sure you don’t outlive your savings is a real concern. Fortunately, there’s a way to protect yourself.

Life insurers provide annuities, the only product in the private marketplace that offers guaranteed income for life. Annuities can play a crucial role in a comprehensive retirement strategy. And thanks to the SECURE Act recently passed by Congress, employers will find It easier to include annuity options in 401(k) retirement plans for their workers.

Before the SECURE Act, few employers included annuities in 401(k) plans because they were responsible for determining whether an insurer could continue to meet its financial commitments into the future. But the SECURE Act allows employers to rely on the work of the state insurance departments, who as part of their regular supervisory duties are responsible for ensuring that life insurers are financially able to make every payment due a retiree.

So, as more employers start offering annuity products in their 401(k) plans, more workers will gain a guaranteed source of retirement income.

Thanks to the peace of mind offered by these annuities, a new survey a few years from now might show folks retiring sooner rather than later.