COVID-19: This is the Time to Think About Life Insurance

COVID-19 has led to the death of almost 200,000 people in the United States and close to a million worldwide. It has also reminded us that the unexpected can happen and that we are all vulnerable.

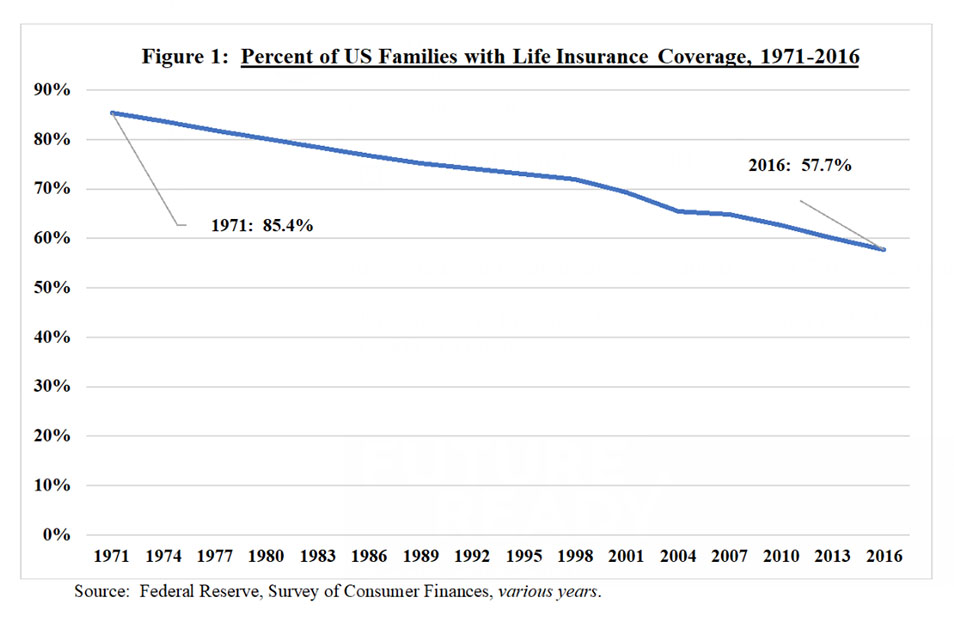

Adequate life insurance coverage offers peace of mind, especially during unstable times such as these. Yet coverage has been steadily declining. In 1971, 85.4% of American families had some coverage, declining to only 57.7% by 2016 (Figure 1).

Today, even insured households usually don’t have enough coverage. Though situations vary, most financial advisors recommend that families have about eight times their annual income in life insurance. In 2018, the average policy-owning family had total income of $76,000. But their average coverage was $140,000, not enough to replace two years of income.

If life insurance is so important, why don’t Americans have sufficient coverage? One reason is that thinking about the purpose of life insurance – financially protecting our families in the event of our death – is unpleasant. So many avoid the subject unless forced to confront it or until it’s too late. Accounting for other factors, a recent study finds that people who experienced the death of a parent or child are 1.4 times more likely to buy a life insurance policy. The study shows that this increase is attributable to the sudden greater awareness of the need for life insurance.

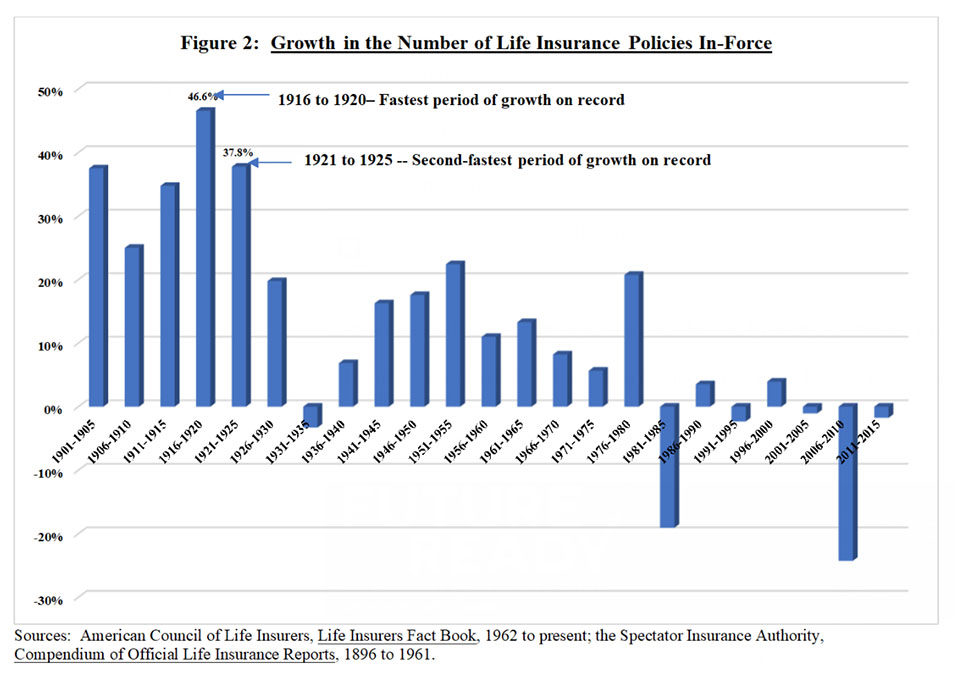

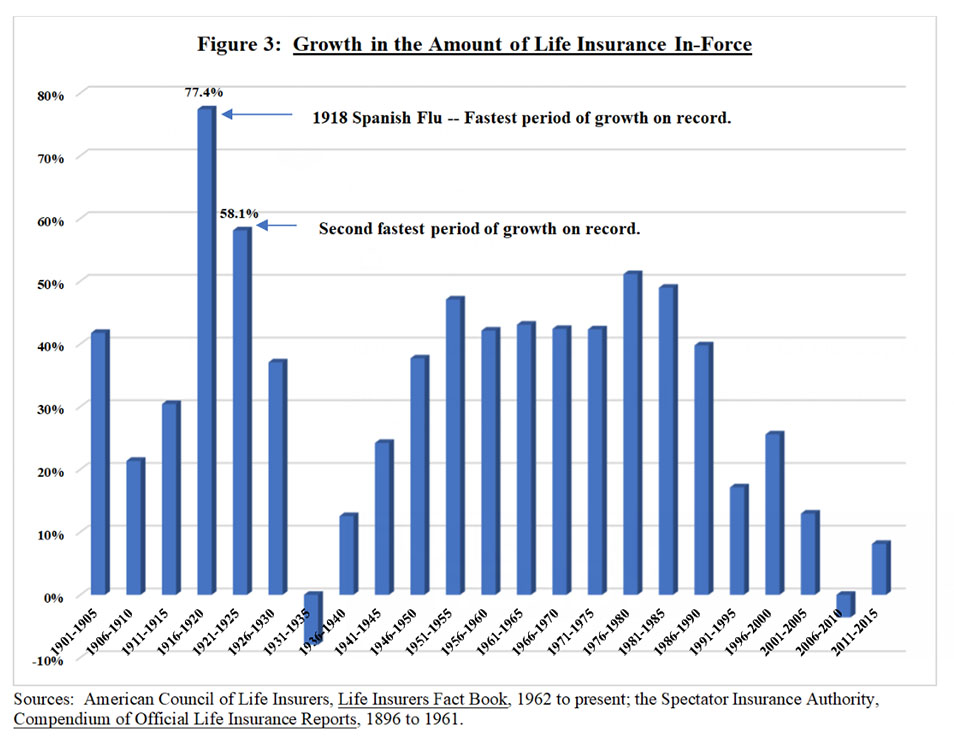

Occasionally it takes a tragic experience to trigger an assessment of our life insurance needs. History supports this. From early 1918 to 1919, the Spanish Flu resulted in 500,000 to 675,000 deaths in the U.S. Though other important factors were at play, during the time periods 1916-1920 and 1921-1925 the number of life insurance policies in-force and the amount in-force grew faster than at any other time in history (Figures 2 and 3). Though COVID-19 isn’t as deadly as the Spanish Flu, it has made us more aware of our vulnerability.

Are we approaching a turning point? Will the pandemic increase our awareness of the importance of life insurance? I certainly hope so.