How Life Insurers Supported the Economy Through the Pandemic

When COVID-19 first appeared in December 2019, few would have predicted that within two years over 5 million people worldwide, including more than 800,000 people in the United States, would have died from the new disease. But COVID didn’t just claim lives. It also destroyed or jeopardized businesses and disrupted the labor market, with unemployment temporarily increasing to levels not seen since the Great Depression.

Since the earliest days of the pandemic, America’s life insurance companies have been helping households deal with these challenges and transitions, both directly and indirectly. Specifically:

- In 2020, life insurers paid out a record $91.6 billion in annuity payments. Some of those payments undoubtedly helped older Americans who left the workforce stay financially secure, safe, and alive. In November 2019, 37.7 million Americans aged 55 or over were employed. By November 2021, only 36.6 million were working – a 1.1 million decline. To stay safe from COVID, the bulk of these people (whether laid-off, discharged, or quit) likely chose to retire earlier than planned.

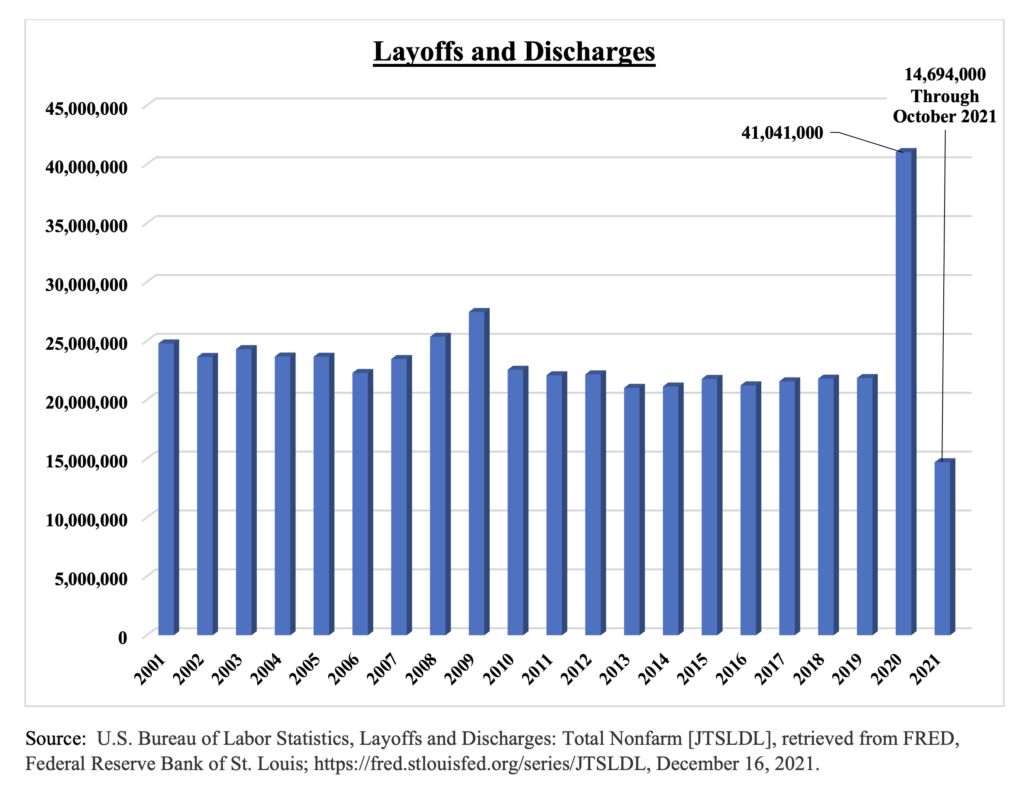

- In 2020, life insurers offered $1.4 trillion in life insurance coverage, an increase of 16.1 percent over 2019. Last year there was more job turnover — hires and layoffs/termination — than in any year since records were kept starting in 2000. When people start a new job, in most cases they are offered various benefits, including group life insurance. Despite 8.9 million fewer people working at year-end 2020 than year-end 2019, the amount of group life insurance in-force was 1.6 percent greater in 2020 than 2019. Many of the newly hired clearly wanted the peace of mind of knowing that their loved ones are protected by life insurance.

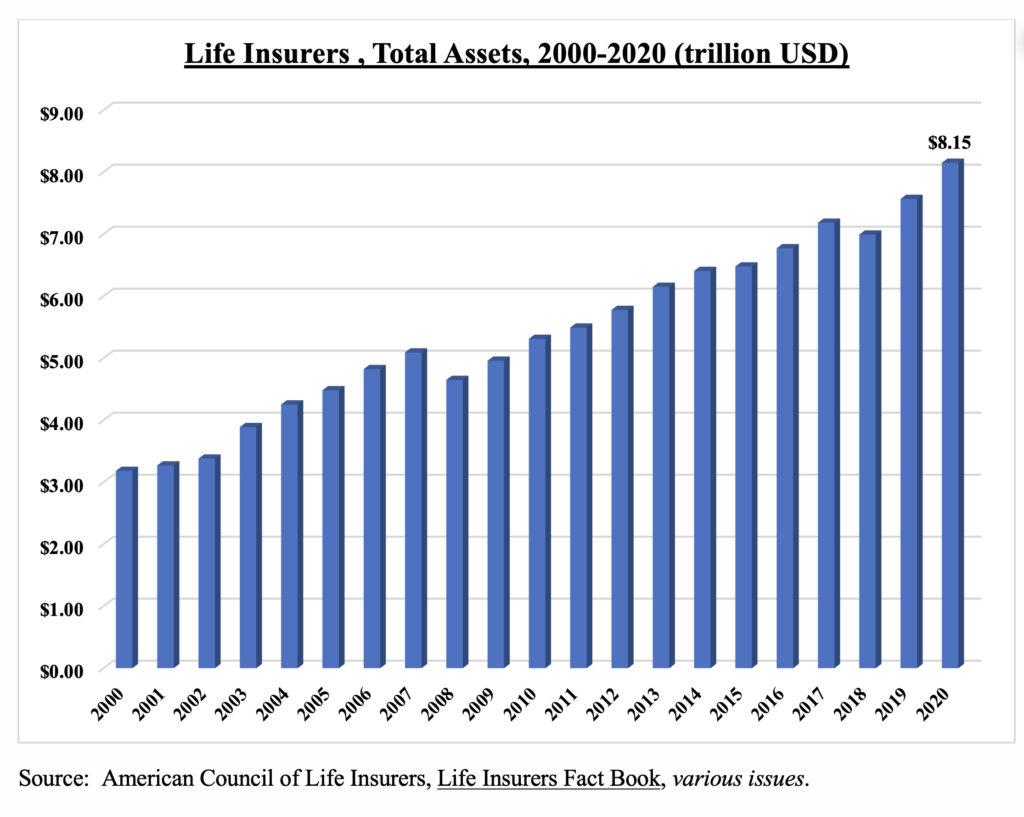

- Throughout the pandemic, life insurers continued to support jobs, businesses, and families nationwide through their investments. As noted in the 2021 ACLI Life Insurers Fact Book, life insurers held a record $8.2 trillion in total assets by year-end 2020. This includes a record $3.9 trillion in bonds, and a record $641.4 billion in commercial and residential mortgages.

Building on more than 175 years of helping families and the economy, life insurers are #MeetingTheMoment for America during the pandemic.