Lennon & McCartney. Peanut Butter & Jelly. Life & Health Insurance?

[Life Insurance 101 Series: This series features IMPACT posts that detail the breadth of the industry’s reach and benefits provided to consumers.]

Great pairs provide great things like:

- great music (Lennon & McCartney);

- great lunches (peanut butter & jelly);

- financial protection (life & health insurance).

Each component of these famous combos is distinctive.

John & Paul’s differences have been well chronicled. Peanut butter and jelly’s differences are clear. But life and health insurance are sometimes confused.

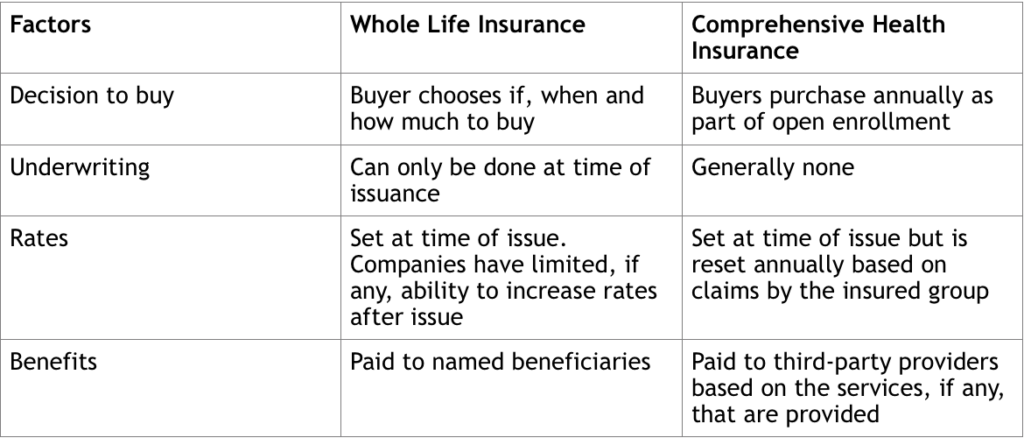

The graphic below highlights key differences from the perspective of a whole life policy and a comprehensive health insurance plan, perhaps one offered by an employer or one individually purchased in the marketplace. (Different policies would require changes to this graphic).

Underwriting, which is the process of evaluating an application and setting a price, is the key distinction.

Consumers are evaluated only at the time of purchase for life insurance. Once issued coverage, a company has limited, if any, ability to increase rates. That is why life insurers seek each applicant’s consent to fully review their medical record. They need to make decision about who to cover and set fair price that reflects the applicant’s health and medical situation at that time.

Health insurance rules differ. For example: The underwriting process tends to be less vigorous. Coverage is often mandatory. Policy premiums can be increased annually if the insured group makes more claims than expected or if claims are more costly than anticipated.

Neither form of insurance is better than the other. They’re just different. Regulating or examining the two as if they’re the same invites trouble.

Like asking John to hit the high harmonies (That was Paul’s job).

Like asking jelly to keep the sandwich bread dry (That’s peanut butter’s job — jelly always in the middle).

You just don’t want to go there.