Low Interest Rates Equal High Costs for Retirement Savers

[First in a series of IMPACT posts examining the impact of a prolonged low interest rate environment]

Since the 2008 financial crisis, much of the world has lived in a low interest rate environment. Low interest rates may be justified from a monetary perspective. But retirees and those in the later stages of their careers bear a substantial cost.

Let’s take a look.

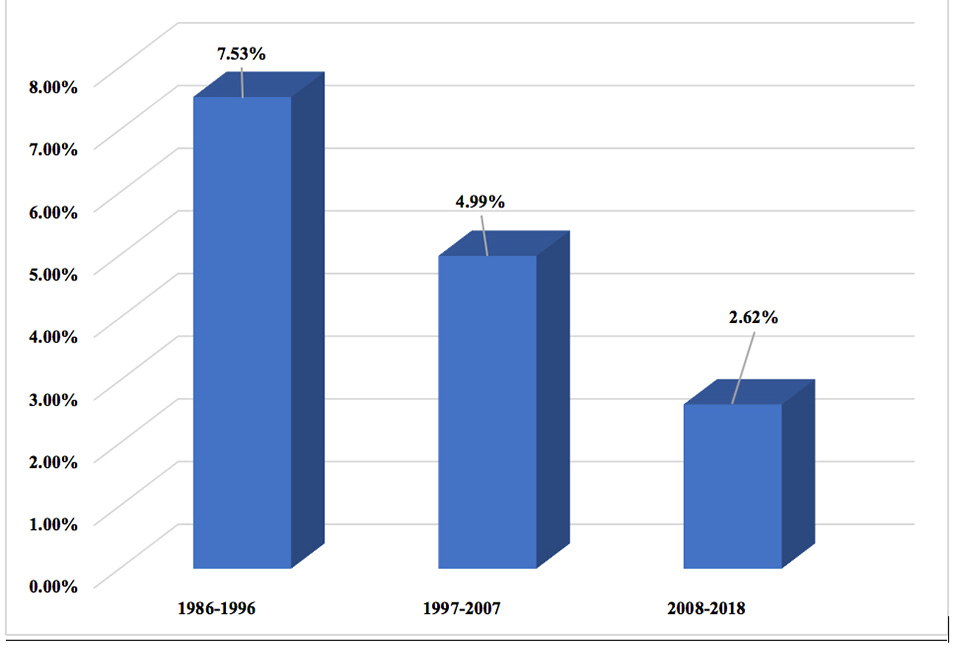

Financial advisors recommend that workers approaching retirement should gradually lower their risk exposure to stocks by rebalancing retirement savings toward safe, fixed return investments such as U.S. Treasury bonds. Though U.S. Treasuries are indeed safe, the returns they offer have reached historic lows. From 2008 to 2018 the average return on a 10-year Treasury bond was just 2.62%, while from 1997 to 2007 it averaged 4.99% and from 1986 to 1996, 7.53% (see Chart 1 below). As of September 2019, 10-year Treasuries paid only 1.7%. Other fixed return assets also offer historically low returns.

Chart 1: Mean 10-Year Treasury Constant Maturity Rate

Source: ACLI calculation of Federal Reserve Bank of St. Louis data (extracted on October 2, 2019).

That’s not all.

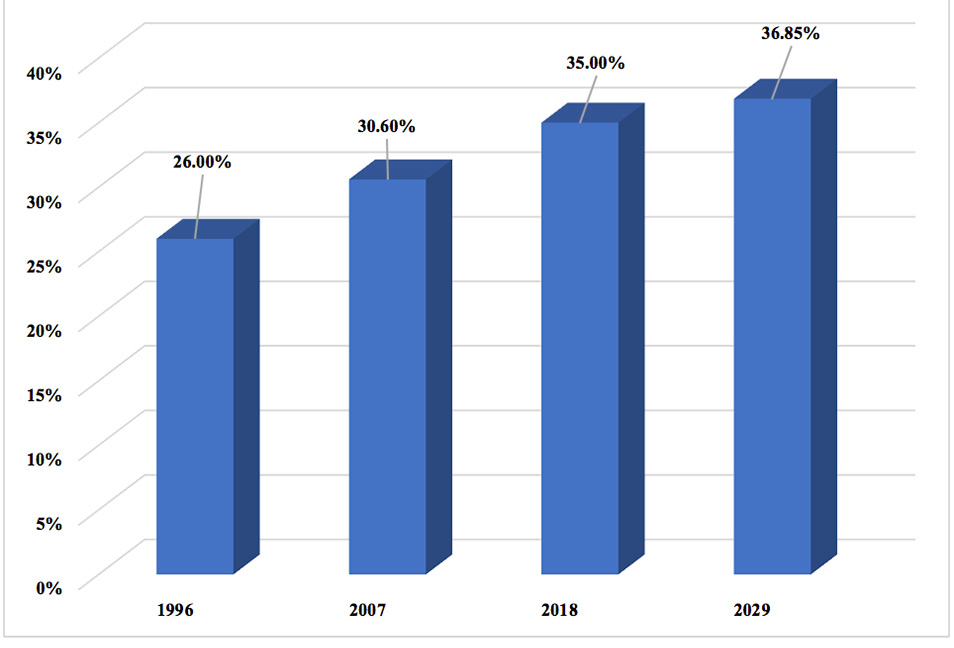

The negative impact of a prolonged low interest rate environment is intensified by demographics. In 1996, about 26% of the U.S. population was age 50 or greater. Today they make up more than 35% of the population, and in ten years they’ll be 37% (see Chart 2 below). There are 117.5 million Americans who are 50 or over today, 47.5 million more than in 1996.

Chart 2: Percent of U.S. Population Age 50 or Over, Various Years

Source: ACLI analysis of U.N. Population Database.

So, what is the best way to prepare for retirement, or effectively live in retirement, given low interest rates?

For those in the early stages of their careers, the best protection is no secret: diligently and consistently save as much as reasonably possible. For those approaching retirement the prescription is similar – save more, but also consider delaying retirement and continuing to work. Working longer will: (1) allow savings to increase; (2) result in larger monthly Social Security payments; and, (3) decrease the number of years without earned income.

Current retirees relying on income from fixed return assets are faced with two realities: consume less and/or return to paid employment. Neither of which is very desirable.

Low interest rates present a substantial challenge to those preparing for retirement and those in retirement. Future IMPACT posts will consider this issue more closely. Stay tuned.