More Than Ever

America’s life insurers serve 90 million American families, helping them build a financial safety net that protects them through all stages of life. As we enter another holiday season affected by the COVID-19 pandemic, the importance of the protection offered by life insurance companies has never seemed greater.

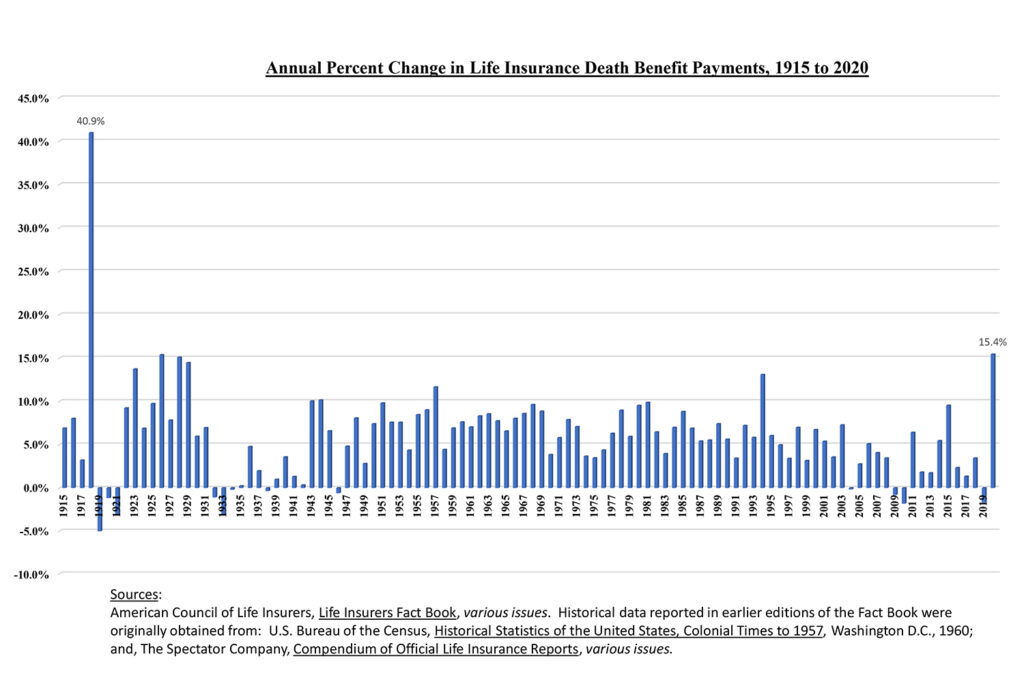

Nearly 800,000 Americans have died due to COVID-19. While we don’t know how many of them had life insurance, we do know that America’s life insurers paid out a record $90.43 billion in death benefit payments in 2020. As noted in a recent Wall Street Journal article, this was 15.4% higher than the payments in 2019. It was the greatest year-to-year increase since 1917-18 during the influenza pandemic.

The death benefit payments and the data in the chart below are taken from the 2021 ACLI Life Insurers Fact Book, which was released this month.

The value of life insurance has been reaffirmed by the pandemic. America’s life insurers paid death benefits of more than $247 million every day in 2020. And given the recent economic disruption that has disproportionately affected underserved communities, the financial support that life insurers make available for all Americans has never been more important.

Sales of new life insurance policies have risen sharply since the pandemic. New life-insurance premiums increased 18% for the first nine months of 2021, the largest in 25 years, according to LIMRA.

This is a significant turnaround. A LIMRA survey earlier this year found that just 52 percent of Americans have life insurance coverage, down from 63 percent just a decade ago.

While no one can predict what the future will hold, everyone can prepare for it. For nearly two centuries, America’s life insurance companies have provided vital financial support for families in need. Life insurance products build financial certainty and enhance prosperity and financial security across generations.

(Khari Cook is Senior Analyst, Research at the American Council of Life Insurers (ACLI). He is primarily responsible for data analysis of life insurers’ quarterly and annual statutory filings, along with company product line and investment survey data.)