Ready for Life’s Twists and Turns

While there is no golden ticket to financial certainty, there are proven paths to get there. And America’s life insurers believe the road to financial certainty should be accessible to everyone.

No significant journey — let alone a lifelong journey — occurs without an obstacle or two emerging along the way. That’s expected. But life’s twists and turns don’t have to derail the trip.

That’s where we come in. For more than 175 years, life insurers have helped people plan for a secure financial future. We’ve been there providing Americans financial certainty through wars, recessions and pandemics.

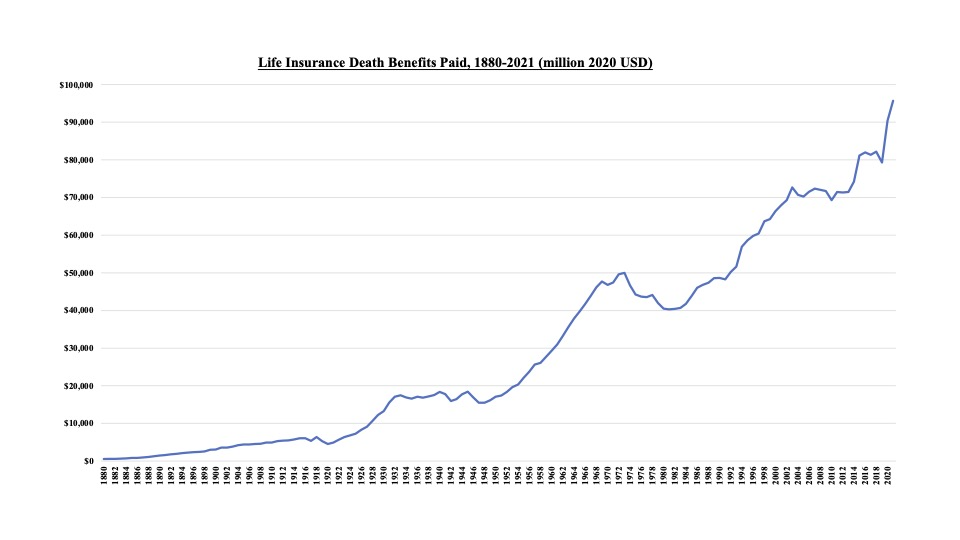

Our value to American families and businesses is as important as ever. In 2021, we paid a record $100 billion to beneficiaries of life insurance policies. We also paid out a record $97.7 billion to annuity holders that year.

At the same time, life insurers are investing approximately $587 million every day, primarily through bond investments that drive economic and job growth across the country. That’s long-term financing that state and local governments, as well as large and small businesses, can rely on in good times and in bad.

The robust state regulatory system combines with life insurers’ prudent risk management and investment strategies so we can make good on promises to policyholders. And life insurers are investing in technology to improve access to our products and services.

While no one can predict what the future will hold, life insurers make sure everyone can prepare for it. When life takes an unexpected turn, our support can transform worries into peace-of-mind.

Lawmakers in Washington D.C. and in state capitals around the country know they can count on the life insurance industry’s stability and strength. We support families in need. We ensure employers can provide for their workers. We invest in communities. And we work with policymakers to relieve Americans’ financial concerns.

Our industry stands ready to work with lawmakers to help advance bipartisan public policies that will increase access to financial security solutions for Americans while supporting communities across the nation.