COVID-19, Unemployment, and Ultra-Low Interest Rates Challenge Older Americans

COVID-19 has challenged the entire world, including retirees and those approaching retirement. People age 55 and over are more likely to fall ill from COVID and much more likely to die from it. They are also more likely to suffer financially.

Since February, 2.5 million older Americans (age 55+) became unemployed. An additional 1.9 million left the labor force entirely. According to an Urban Institute study cited in a previous IMPACT post, 56% of older workers who involuntarily leave their jobs suffer “serious financial consequences,” with median incomes falling 42% and only 1 in 10 finding employment for the same or greater salary. Importantly, this study was released in December 2018, well before COVID, when the unemployment rate for older workers was 2.8%, compared to 9.7% in June 2020. In the current environment, finding an appropriate job will likely be even more difficult.

In addition to the threat of unemployment, older Americans face another challenge – how to manage or prepare for retirement given a volatile stock market and near-zero interest rates. The Dow Jones Industrial Average plummeted more than 35% earlier this year. It has rebounded, but is still down more than 6% year-to-date. Financial advisors recommend that as workers approach retirement, they gradually rebalance their retirement savings away from stocks toward safe, fixed return investments including U.S. Treasury bonds. But given the miniscule returns on fixed-return investments, older Americans are facing a risk vs. little return dilemma.

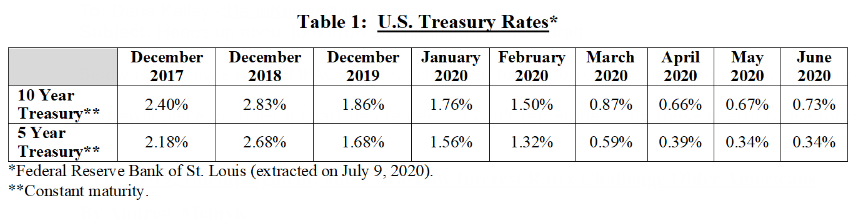

As noted in an earlier IMPACT post, interest rates have been at historic lows in recent years. In response to COVID, the Federal Reserve has maintained a near-zero Federal Funds Rate and has actively intervened in debt markets, pushing market rates even lower. Since March 2020, the 5-Year and 10-Year Treasury Bond rates have been less than 1%, (see Table 1).

How can retirees best manage their retirement savings amid a health crisis, employment uncertainty, and lower investment income due to near-zero interest rates? For those with sufficient savings, an annuity is an answer. Annuities are the only product in the private marketplace that offer guaranteed income for life.