What’s the Difference of a Few Percentage Points for Retirement Savers?

As previously discussed, the United States is in a low interest rate environment. Low interest rates negatively impact people saving for retirement, including those who invest in fixed-return assets (assets that pay people a set interest rate). They can have a particularly severe impact on retirees and those nearing retirement.

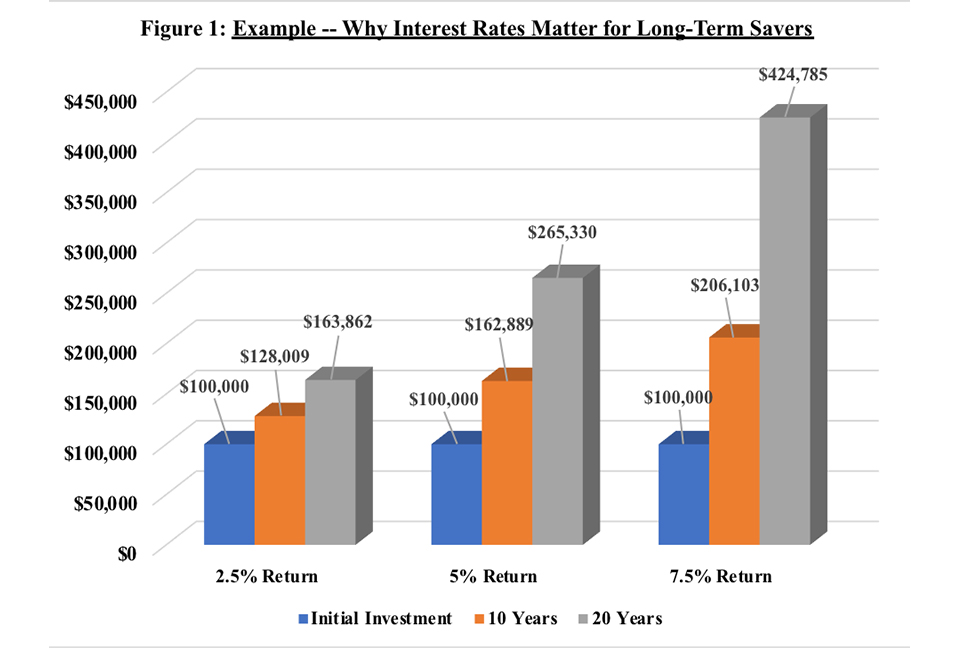

But how much do a few percentage points really matter? Consider two simple examples:

1) A 50-year-old invests $100,000 in a fixed-return asset that pays 2.5%, compounded annually.

- Putting aside taxes, 10 years later she’ll have $128,009.

- If the investment pays 5.0%, she would have about $162,889.

- If it pays 7.5%, she would have $206,103.

If she holds the investment for an additional 10 years, the difference is even more stark.

- After 20 years, the balance on a $100,000 investment paying a return of 7.5% will be more than twice as large as one paying just a 2.5% return.

- $424,785 vs. $163,862 (see chart below). Inflation will have an impact on the actual value of those dollars, but the difference in savings is obvious.

2) A newly retired 65-year-old saved $500,000 with which he intends to fund his retirement. He plans on withdrawing $50,000 annually to supplement his Social Security income and a lifetime annuity that he owns.

- He’ll keep the remainder of his money in a fixed-return investment that pays 2.5% interest.

- In this scenario, our retiree will run out of supplemental money when he’s 76. If his investment pays 5.0%, he runs out at 78.

- If it pays 7.5%, he runs out at age 81.

In this example, a five-percentage point difference means more than five additional years of retirement income. Given that the typical 65-year-old can expect to live to age 85 (half will live longer), five years represents one-quarter of his hopeful retirement.

The real world is more complicated than these simple examples. For the sake of brevity, we assumed away several important things. And there are key products like annuities that can ensure a steady income throughout retirement. But the main point is clear – interest rates matter for retirement savers and retirees!